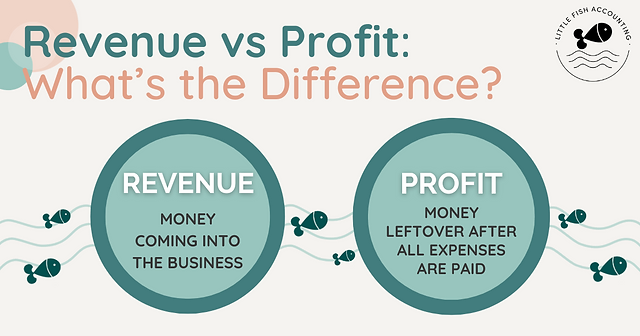

Revenue vs Profit: Understanding the Key Differences

In the world of business and finance, terms like revenue and profit are often used interchangeably, but they represent distinct concepts with significant implications for a company’s financial health and performance. Understanding the difference between revenue and profit is essential for business owners, investors, and anyone interested in financial literacy. In this article, we’ll explore the definitions of revenue and profit, their differences, and why they matter.

Revenue:

Revenue, also known as sales or turnover, refers to the total amount of money generated from selling goods or services during a specific period. It is the top line of a company’s income statement and represents the total inflow of cash or receivables before deducting any expenses. Revenue can come from various sources, including product sales, service fees, subscription revenue, licensing agreements, and advertising revenue.